Essential Tax Deadlines for Your Business in 2024

Dec 18th 2024

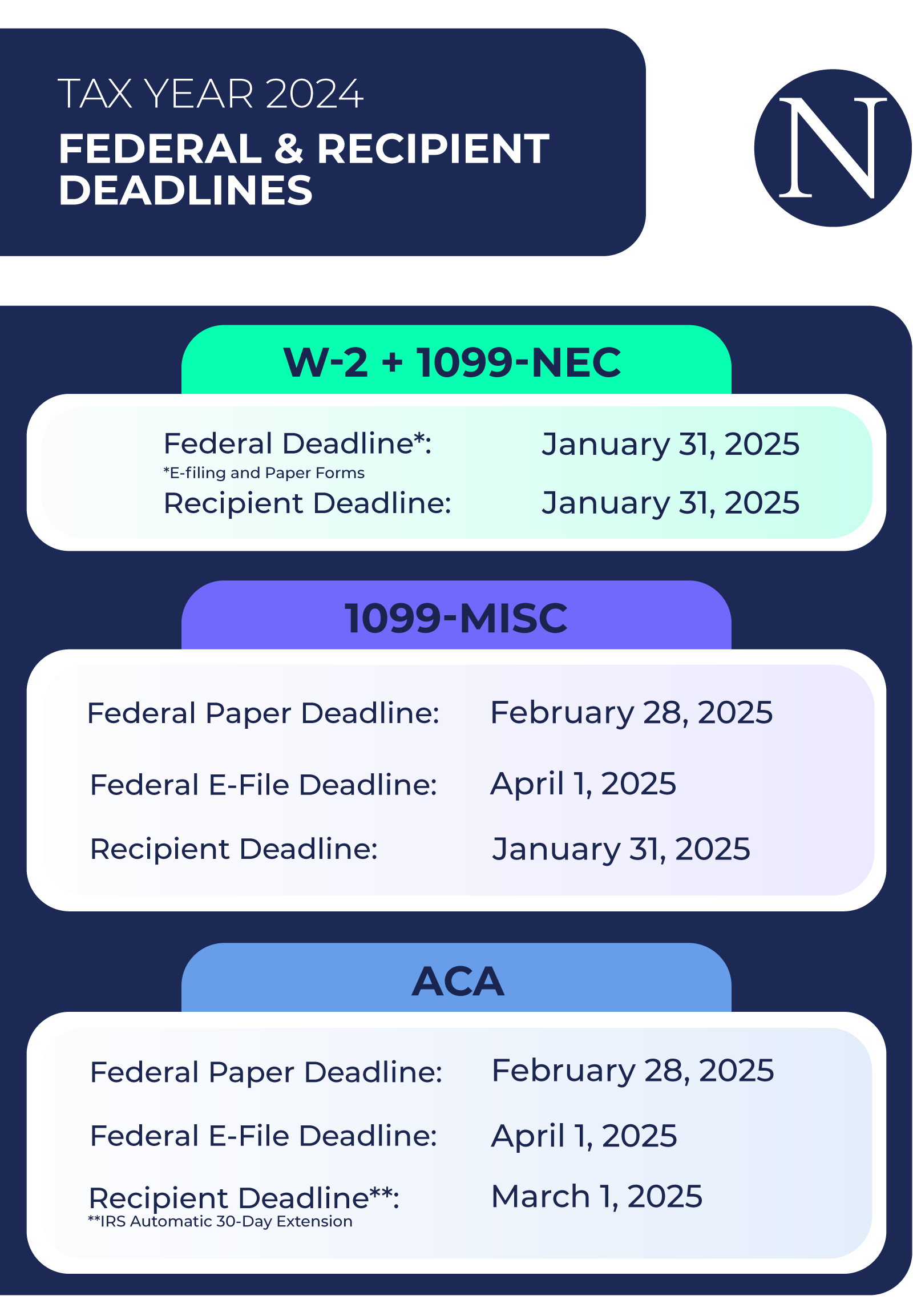

Staying ahead of W-2, 1099, and 1095 filing deadlines is critical for businesses to avoid penalties and ensure compliance. The essential deadlines for year-end forms in 2024 are fast approaching. Here’s a quick breakdown:

If the due date falls on a weekend or holiday, the due date is the next business day.

If the due date falls on a weekend or holiday, the due date is the next business day.

To help avoid penalties and last-minute stress, in addition to knowing important deadlines, businesses should use a complete electronic filing program to submit forms to the IRS, SSA, and recipients. A complete filing program with seamless data transfer ensures accurate and timely submissions. Start early and use streamlined tools to simplify filing, reduce compliance risks, and meet key deadlines with ease.

A complete electronic filing program, like Nelco, may be available through your software. Nelco is a leader in wage and information reporting products and technology. For more form types or state deadlines, view Nelco's deadline calculator >